The consolidation of what was once hundreds of railroads into just seven class 1 railroads today (plus Amtrak) was always controversial. In 1901, to protect his railroads from raiders such as Edward Harriman, James J. Hill created the Northern Securities Company to hold the stock of Great Northern and Northern Pacific. Though this did not operationally merge the two railroads, the Supreme Court held that it violated anti-trust legislation.

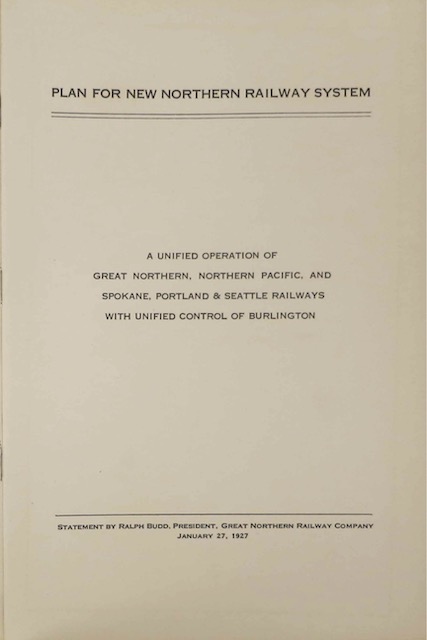

Click image to download a 2.7-MB PDF of this 22-page booklet.

Click image to download a 2.7-MB PDF of this 22-page booklet.

By 1920, attitudes towards mergers had changed. As this booklet (which I photographed at the Minnesota History Center) notes, the law at the time of court’s Northern Securities decision was based on the “theory that unbridled competition was of paramount importance in giving the public good, ample, and cheap railroad service.” By the 1920s, that theory was considered “mistaken,” and instead competition was considered “ruinous” because it led to too much duplication of effort.

This was probably due as much to the opening of the Panama Canal as anything else, as that greatly reduced the demand for transcontinental freight traffic. Railroads such as the Milwaukee Road and Western Pacific, which might have made money without the canal, instead went into bankruptcy after the canal opened.

In response to the new view that competition was bad, the British Parliament passed the Railways Act of 1921 that forced more than 100 railroads in Britain to consolidate into just four companies which, for the most part, didn’t directly compete with one another. The U.S. Congress asked the Interstate Commerce Commission to put together a proposal for consolidating American railroads, which was also published in 1921.

The proposal called for merging more 130 railroads (and their numerous subsidiaries) into 19 different systems. In the Northwest, one railroad would be formed by merging the Northern Pacific with the Burlington along with several smaller roads (CGW, M&StL, SP&S). Another would consist of the Great Northern merged with the Chicago, Milwaukee & St. Paul along with five or six smaller roads (SP&S was on the list for both mergers).

GN President Ralph Budd didn’t think much of that plan. Instead, he proposed that Great Northern merge with the Burlington, leaving the Northern Pacific to merge with the St. Paul road. But apparently the Burlington was considered much more valuable to the GN and NP than the St. Paul, and the NP warned that it would fight to keep access to the Burlington.

Thus, in 1927, GN and NP presented this proposal to merge. Since they each owned half of the SP&S, it would be included in the merger. They also each owned 48.6 percent of the Burlington; it would continue to be controlled by the new company but would operate as a separate company. By reducing duplicate lines and terminals, the booklet argues, the merger would save the railroads $70 million per year.

The booklet offered two arguments in response to those who still believed in the value of competition to keeping rates low. First, it noted that GN and NP’s branch lines did not generally compete with one another: 60 percent of NP’s rail routes were on the western half of the railroad while 58 percent of GN’s were on the eastern half. Second, the booklet argued that, even if there was less competition in the region, regions competed with one another, so the merged railroads would be compelled to keep rates low in order to allow the Northwest to compete with, say, the Southeast.

Of course, the merger didn’t happen for 43 more years. By that time, Ralph Budd’s son, John Budd, was president of the Great Northern, and he seemed to consider the merger to be his mission as president.

Today, nearly 100 years after the ICC report and 50 years after the BN merger, competition is more highly valued. Where the nation once had at least three different railroads competing between almost every major city-pair, we now have at most two. In the West, that’s a direct result of the BN merger, which ended up killing the Milwaukee Road, as well as the Penn Central merger in the East and the Seaboard Coast Line merger in the South. We might have been better off if GN, NP, and the St. Paul road had all been parts of separate consolidations; perhaps the GN with the Burlington, the NP with the C&NW, and the St. Paul/Milwaukee with the UP. But we’re stuck with what we’ve got.

Did the ICC ever make anything more competitive? Shoot they did not even force the NYC to sell the west shore line to the Nickel Plate road. That would have made perfect competition from NY to Chicago.